Harvey Closures Reduce Available Texas Refining Capacity – S&P Global Platts

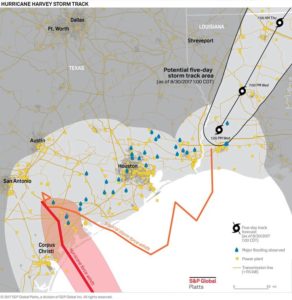

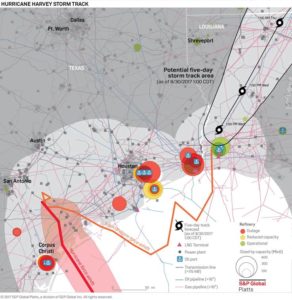

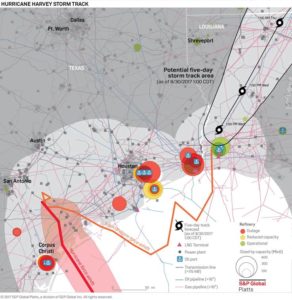

NEW YORK (August 30, 2017) – 6:30 pm ET – While some Texas refiners were beginning to restart operations Wednesday as Tropical Storm Harvey moved into Louisiana, others were bringing plants down, causing a further reduction in available refining capacity, according to a Wednesday evening ET report by S&P Global Platts, the leading independent provider of information and benchmark prices for the commodities and energy markets.

Motiva, Total and Valero shut their Port Arthur, Texas plants, although Valero was preparing to restart its Corpus Christi and Three Rivers refineries and Marathon was restarting its Texas City plant. [1]

[1]

[1]

[1]The Port Arthur outages bring the storm-related outages to 3.04 million b/d, or 16% of total US capacity. Assuming refiners cutting runs or in the process of returning are at 50% of capacity, the total downed capacity rises

to 4 million b/d (22% of the US total).

Vessel traffic into and out of the US Gulf Coast has largely been closed, restricting oil and refined products imports and exports. Weather conditions in Houston and offshore have improved after Tropical Storm Harvey shifted

toward Louisiana.

Houston-Galveston port officials hope to restart limited ship movements soon, the Greater Houston Port Bureau said Wednesday, although higher currents from rivers and bayous will make navigation a challenge for some vessels, even after port facilities reopen.

Corpus Christi officials hope to reopen ports by September 4.

PRICES

-

Gulf Coast RBOB with 11.5 RVP was assessed at NYMEX October RBOB plus 32 cents/gal, a 14.75 cents/gal climb from Tuesday. Gulf Coast CBOB was assessed at NYMEX October RBOB plus 28.25 cents/gal, while conventional grade was assessed at futures plus 27.75 cents/gal.

-

Atlantic Coast gasoline drew support not only from higher Gulf Coast prices but also from Mexico demand. New York Harbor RBOB was assessed 3 cents/gal higher at NYMEX September RBOB plus 5.25 cents/gal, its highest price since November 7. Multiple market sources said PEMEX was scheduling gasoline cargoes out of the New York Harbor to deliver to Mexico, a regular buyer of USGC gasoline.

-

European gasoline prices have soared over two consecutive sessions on extra demand for cargoes required on the US Atlantic coast to substitute supply unable to leave the US Gulf Coast. The September Eurobob gasoline crack

-

swap was assessed at $18.30/b, up $2.80/b on the day, and the highest since August 13, 2015, when it was assessed at $18.85/b.

TRADE FLOW

-

Harvey-related gasoline shortages may start to appear in the US by Friday and get exacerbated by the high-demand Labor Day holiday weekend, fuel marketers trade group SIGMA said. SIGMA CEO Ryan McNutt expects the group’s members to have serious supply challenges in the coming days. “Price isn’t going to be the main issue,” he said Wednesday. “There’s just not going to be product, and unfortunately we’re going into one of the busiest traveling weekends for that.”

-

Mexico, a large buyer of US Gulf Coast refined products, has turned to refineries along the Canadian and US Atlantic Coasts for fuel supply. The Largo Sun is currently loading at the IMTT terminal in Bayonne, New Jersey, according to data from Platts’ cFlow trade flow software. After loading, the ship will depart for the east coast of Mexico, according to multiple market sources. A source with knowledge of Mexican imports said the country has been looking to purchase gasoline “everywhere” and that it still needs more imports to satisfy its supply needs.

-

Medium Range tanker freight rates west of Suez have surged, with demand forgasoline shipments westwards the key driver. Europe will now have to provide clean product to markets the US Gulf normally supplies, such as Latin America, Brazil, Argentina and even the US West Coast, in addition to gasoline for US consumers. The UK Continent-US Atlantic coast route, basis 37,000 mt, was assessed at Worldscale 160 on Tuesday, up w35 from Friday.

-

Trading companies in Asia are keeping their options open to deliver jet fuel or gasoline cargoes into the US or South America and are already making changes to their fixtures. “Lots of last week’s fixtures are now being changed to have additional [destination] options such as Brazil and US West Coast,” a source said.

-

Various Northeast Asian end-users are bracing themselves for possible lengthy delays in the delivery of North and Central American crude oil supply, with three South Korean refiners expecting to receive cargoes from the US and Mexico behind their initial September schedule.

REFINERIES

Roughly 3.04 million b/d of Texas refining capacity remained down, or 16% of US capacity. Assuming the plants cutting runs or returning are operating at 50%, that would put the total loss at 4 million b/d, or 22% of total US

capacity. The following plants have been shut down:

Company Location Capacity (b/d)

ExxonMobil Baytown, TX 560,500

ExxonMobil Beaumont, TX 362,300

Citgo Corpus Christi, TX 157,500

Magellan Corpus Christi, TX 50,000

Buckeye** Corpus Christi, TX 50,000

Shell Deer Park, TX 340,000

Petrobras Pasadena, TX 112,229

Motiva Port Arthur, TX 603,000

Total Port Arthur, TX 225,500

Valero Port Arthur, TX 335,000

Phillips 66 Sweeny, TX 247,000

Total capacity closed 3,043,029

Share of US capacity 16%

* The following plants have reduced rates or are returning:

Company Location Capacity (b/d) 50% of Capacity (b/d)

Flint Hills*** Corpus Christi, TX – West 230,000 115,000

Flint Hills*** Corpus Christi, TX – East 70,000 35,000

Valero*** Corpus Christi, TX 293,000 146,500

Valero*** Three Rivers, TX 89,000 44,500

Lyondell Houston, TX 263,776 131,888

Valero Texas City, TX 225,000 112,500

Marathon*** Galveston Bay, TX 459,000 229,500

Marathon Texas City, TX 86,000 43,000

Valero Houston, TX 191,000 95,500

Total capacity reduced 953,388

Closed + reduced capacity 3,996,417

Share of US capacity 22%

***Returning

GOVERNMENT RESPONSE

-

The US Environmental Protection Agency Wednesday expanded emergency gasoline waivers to 12 states and the District of Columbia to prevent storm-related supply disruptions in the South, Southeast and Mid-Atlantic gasoline markets. The agency waived through September 15 requirements for reformulated gasoline and low-volatility gasoline in Alabama, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, South Carolina, Tennessee, Texas and Virginia as well as the District of Columbia. Parts of Texas, Louisiana and Georgia already received waivers to the rules as a result of Harvey.

PIPELINES AND RAIL

-

Colonial Pipeline is running at reduced capacity due to limited supply from Houston refiners. Colonial delivers refined products to the US Northeast.

-

The Explorer Pipeline hauling refined products from Texas to Illinois closed at midnight Tuesday to allow product to back up at the start of the line and enable faster deliveries at the northern end. The line should reopen sometime before Friday.

-

Magellan Midstream has suspended operations on two long-haul pipelines — BridgeTex and Longhorn. The two pipelines carry a combined 675,000 b/d of crude from the Permian Basin in Texas to the US Gulf Coast.

-

Kinder Morgan shut down “select systems” of its 300,000 b/d crude and condensate pipeline in Texas. The shut-in is being implemented on the 250-mile Kinder Morgan Crude and Condensate line.

-

Kansas City Southern Railway Company’s force majeure and embargo for areas in its network in Texas impacted by Tropical Storm Harvey were in place Monday. On Friday, the Kansas City-based company declared force majeure

-

and an embargo on shipments via Laredo and Brownsville-Matamoros going to Houston and Corpus Christi.

-

Deliveries from Seaway and Enterprise crude oil distribution systems to certain delivery points may be on allocation from time to time or not in service subject to disruptions of electrical power to pump stations and/or restrictions at receipt points.

PORTS AND TERMINALS

-

The Houston Ship Channel remained closed Wednesday to incoming and outgoing traffic with talk of opening some areas within 24-48 hours. Officials are hoping to allow traffic into the Bayport Container Terminal within “one or two days,” a dispatcher said. There are reports that a dry dock and towing vessel may have sunk or been lost in the storm, according to two dispatchers. Several bunker fuel suppliers did not expect the Houston Ship Channel to open fully until next week. It “will take some time,” one source said. “The bayous need to drain and that affects the port with debris.”

-

The US Coast Guard set port condition Zulu for Louisiana port Lake Charles and Texas ports Beaumont, Nederland, Orange, Port Arthur, Port Neches, Sabine and Sabine Bar, closing all inbound and outbound traffic.

-

Corpus Christi port is still targeting September 4 for a return to normal operations, spokeswoman Patricia Cardenas said Wednesday. The port remains closed — to all but limited inner harbor traffic — for damage assessments and while the US Army Corps of Engineers surveys shipping channels. Initial assessments over the weekend found “light to moderate” damage and debris from the storm, she said.

ONSHORE OIL AND GAS PRODUCTION

-

Oil operators in the onshore Eagle Ford Shale in South Texas began to restart wells and related midstream facilities. ConocoPhillips expects to resume drilling and completion activities in the Eagle Ford Shale on Wednesday. Marathon Oil and EOG Resources were inspecting and assessing their Eagle Ford Shale operations and have begun to restart production where possible. BHP Monday said it was ramping up production. Before the storm hit, the Eagle Ford was producing about 1.341 million b/d of oil and 5.1 Bcf/d of natural gas, according to data from Platts Analytics’ Bentek Energy.

OFFSHORE OIL AND GAS PRODUCTION

-

Some US Gulf of Mexico offshore production remained offline Wednesday. The US Bureau of Safety and Environmental Enforcement showed 323,760 b/d of oil output shut-in on Wednesday, or 18.50% of total Gulf of Mexico output. That was up from 319,523 b/d Tuesday, but down from 428,568 b/d Saturday.

–Staff reports, [email protected] [3]

Contact

Americas: Kathleen Tanzy, + 1 917 331 4607 [4], [email protected] [5]

EMEA: Arnaud Humblot +44 207 176 6685 [6], [email protected] [7] and Alex Brog +44 207 176 7645 [8], [email protected] [9]

Singapore: Platts ([email protected] [10])

|

About S&P Global Platts

At S&P Global Platts, we provide the insights; you make better informed trading and business decisions with confidence. We’re the leading independent provider of information and benchmark prices for the commodities and energy markets. Customers in over 150 countries look to our expertise in news, pricing and analytics to deliver greater transparency and efficiency to markets. S&P Global Platts coverage includes oil and gas, power, petrochemicals, metals, agriculture and shipping.

S&P Global Platts is a division of S&P Global (NYSE: SPGI), which provides essential intelligence for individuals, companies and governments to make decisions with confidence. For more information, visit www.platts.com [11].

|